Magazine for the professional tire industry

Issue link: https://mtd.epubxp.com/i/762675

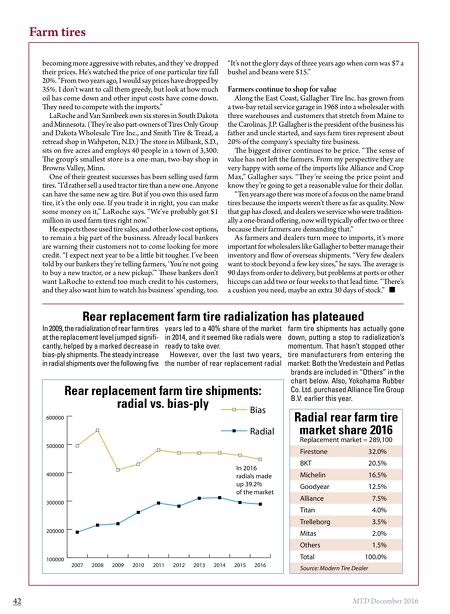

MTD December 2016 Farm tires becoming more aggressive with rebates, and they've dropped their prices. He's watched the price of one particular tire fall 20%. "From two years ago, I would say prices have dropped by 35%. I don't want to call them greedy, but look at how much oil has come down and other input costs have come down. ey need to compete with the imports." LaRoche and Van Sambeek own six stores in South Dakota and Minnesota. (ey're also part-owners of Tires Only Group and Dakota Wholesale Tire Inc., and Smith Tire & Tread, a retread shop in Wahpeton, N.D.) e store in Milbank, S.D., sits on five acres and employs 40 people in a town of 3,300. e group's smallest store is a one-man, two-bay shop in Browns Valley, Minn. One of their greatest successes has been selling used farm tires. "I'd rather sell a used tractor tire than a new one. Anyone can have the same new ag tire. But if you own this used farm tire, it's the only one. If you trade it in right, you can make some money on it," LaRoche says. "We've probably got $1 million in used farm tires right now." He expects those used tire sales, and other low-cost options, to remain a big part of the business. Already local bankers are warning their customers not to come looking for more credit. "I expect next year to be a lile bit tougher. I've been told by our bankers they're telling farmers, 'You're not going to buy a new tractor, or a new pickup.'" ose bankers don't want LaRoche to extend too much credit to his customers, and they also want him to watch his business' spending, too. "It's not the glory days of three years ago when corn was $7 a bushel and beans were $15." Farmers continue to shop for value Along the East Coast, Gallagher Tire Inc. has grown from a two-bay retail service garage in 1968 into a wholesaler with three warehouses and customers that stretch from Maine to the Carolinas. J.P. Gallagher is the president of the business his father and uncle started, and says farm tires represent about 20% of the company's specialty tire business. e biggest driver continues to be price. "e sense of value has not le the farmers. From my perspective they are very happy with some of the imports like Alliance and Crop Max," Gallagher says. "ey're seeing the price point and know they're going to get a reasonable value for their dollar. "Ten years ago there was more of a focus on the name brand tires because the imports weren't there as far as quality. Now that gap has closed, and dealers we service who were tradition- ally a one-brand offering, now will typically offer two or three because their farmers are demanding that." As farmers and dealers turn more to imports, it's more important for wholesalers like Gallagher to beer manage their inventory and flow of overseas shipments. "Very few dealers want to stock beyond a few key sizes," he says. e average is 90 days from order to delivery, but problems at ports or other hiccups can add two or four weeks to that lead time. "ere's a cushion you need, maybe an extra 30 days of stock." ■ 100000 200000 300000 400000 500000 600000 Bias Radial In 2016 radials made up 39.2% of the market 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Rear replacement farm tire shipments: radial vs. bias-ply Radial rear farm tire market share 2016 Replacement market = 289,100 Firestone 32.0% BKT 20.5% Michelin 16.5% Goodyear 12.5% Alliance 7.5% Titan 4.0% Trelleborg 3.5% Mitas 2.0% Others 1.5% Total 100.0% Source: Modern Tire Dealer Rear replacement farm tire radialization has plateaued In 2009, the radialization of rear farm tires at the replacement level jumped signifi- cantly, helped by a marked decrease in bias-ply shipments. The steady increase in radial shipments over the following five years led to a 40% share of the market in 2014, and it seemed like radials were ready to take over. However, over the last two years, the number of rear replacement radial farm tire shipments has actually gone down, putting a stop to radialization's momentum. That hasn't stopped other tire manufacturers from entering the market: Both the Vredestein and Petlas brands are included in "Others" in the chart below. Also, Yokohama Rubber Co. Ltd. purchased Alliance Tire Group B.V. earlier this year. 42